What do you think about when you think about buying a new house? Where it will be, a type of house, your aspiration, budget, and down payment amount. But do you know all of this could take a hit if you don’t have the power of a strong 3-digit credit score backing your application? To get a home loan or be it any type of loan, your credit report must demonstrate a good credit history. It is only after that that your chances of availing a loan at a better interest rate at better loan terms increase. Thus, it is imperative that when you check credit score, you should know which factors can and cannot take your credit score up or down.

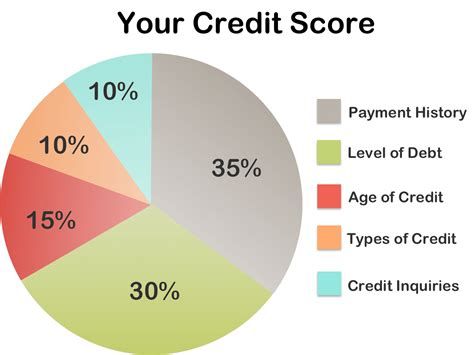

Payment History: Your payment history is the main determinant of your credit score and says a lot about how you’ve handled borrowing money. There are many free portals where you can check free credit score. Paying your loan EMIs and credit card dues on time is all that is necessary to keep this section in good condition as well. The single best thing you can do to improve your credit is to pay your bills on time each month. Your payment history accounts for approx. 35% of your credit score. Late payment remains on your credit report for quite a long before it is removed. You can prevent an accidental late payment by setting up automatic recurring payments.

Balance Credit: The second most significant factor, which accounts for 30% of the credit score, is the credit balance and utilization. The best strategy is to keep the balances on all of your credit cards low, which you can do by following a regular repayment schedule and check free credit score. The sum of all outstanding credit card balances divided by the total credit card limits gives you your credit utilization. For a decent credit score and to avoid engaging in credit-hungry behaviour, it is suggested to keep your credit utilization ratio at 30% or lower.

Age of Credit Account: Lenders can assess your stability as a borrower more easily if you have a longer credit history. They can determine from this feature whether you are a trustworthy borrower and whether you take out many loans. This percentage, which makes up 10% of your credit score, can be maintained by only taking out loans when necessary. You should completely avoid availing of loans unless you need to.

Credit Mix: A strong credit history demonstrates your ability to manage loans but different types of credit support this fact. Getting the necessary loans to improve your credit record. Therefore, having credit cards and instalment loans, such as a home loan or car loan, will benefit you the most. However, this does not imply that you ought to apply for a new loan and check free credit score merely to improve your credit score. Instead, simply apply for the credit you require and watch as, over time, how good loan management habits help your credit score to gradually increase.

New Credit: When you apply for new credit or check credit score, it temporarily lowers your credit score. Your credit score starts improving more quickly once you start making payments than it did when you first sought credit. New credit generally lowers your credit score, although this effect only lasts a short while. An inquiry on your credit report when you check credit score is the result of new credit applications, which marginally lowers your credit score.

Factors that don’t affect your credit score

There are many myths about factors that could or couldn’t have any implication on your credit score. For example, there is a myth that outstanding electricity bills could lower your credit score. Here are some of the myths.

Bank account balance: Despite what many people think, bank overdrafts don’t damage your credit. In actuality, neither check free credit score or credit report, nor does your credit score contain any information on your current or savings accounts.

Phone and utility bills: Typically, your phone, gas, water, and electricity bills are not included in your credit report.

Your assets and income: It doesn’t matter to the credit bureaus whether your in-hand income is 1 lac or 50,000. Everything that affects your credit report is how well you handle your balances and pay your credit-related expenses on time. You can have a check credit score, and it turns out it is low and have a loaded balance in your bank account.

Checking your credit score yourself: Your credit score is unaffected if you check your credit score by yourself. These are regarded as soft enquiries, which you can see but lenders cannot. The hard inquiry on your credit report occurs when you apply for new credit that does affect your credit score.

Rate-shopping: It is considered a good idea to search around for cheap and reasonable interest rates if you’re buying a new car or house. While each application will result in a new inquiry, the credit bureaus often combine inquiries from a short period and regard them as a single inquiry.

Salary cut: Your personal and financial circumstances could be impacted by a pay cut, but your credit ratings won’t be immediately impacted. Although your salary isn’t typically taken into account when determining credit scores, it’s crucial to be aware that some creditors and lenders do so when assessing a credit application. They might also look at your debt-to-income ratio or how much debt you have in relation to your income. To see whether your credit score is high, check free credit score available on many portals.

Paying with a debit card: Using a debit card instead of a credit card won’t affect your credit history or scores. Using a credit card to make a purchase is equivalent to borrowing money that you will have to repay later. Using a debit card allows you to access funds that are already in an account.

Conclusion

There is no need to say it, but you should know that your credit score is one of the most important scores to be able to get credit on better terms. Experts advise you to check credit score quite often if you are about to apply for new credit as it can be a determining factor in getting your loan application approved and helping you get a loan at a better r interest rate. And, we all know how a difference in interest rate can help you save thousands and lakhs. Aforesaid factors can help you know in advance what you can do in advance that will help you raise your credit score.